Active Risk Allocation (ARA) update:

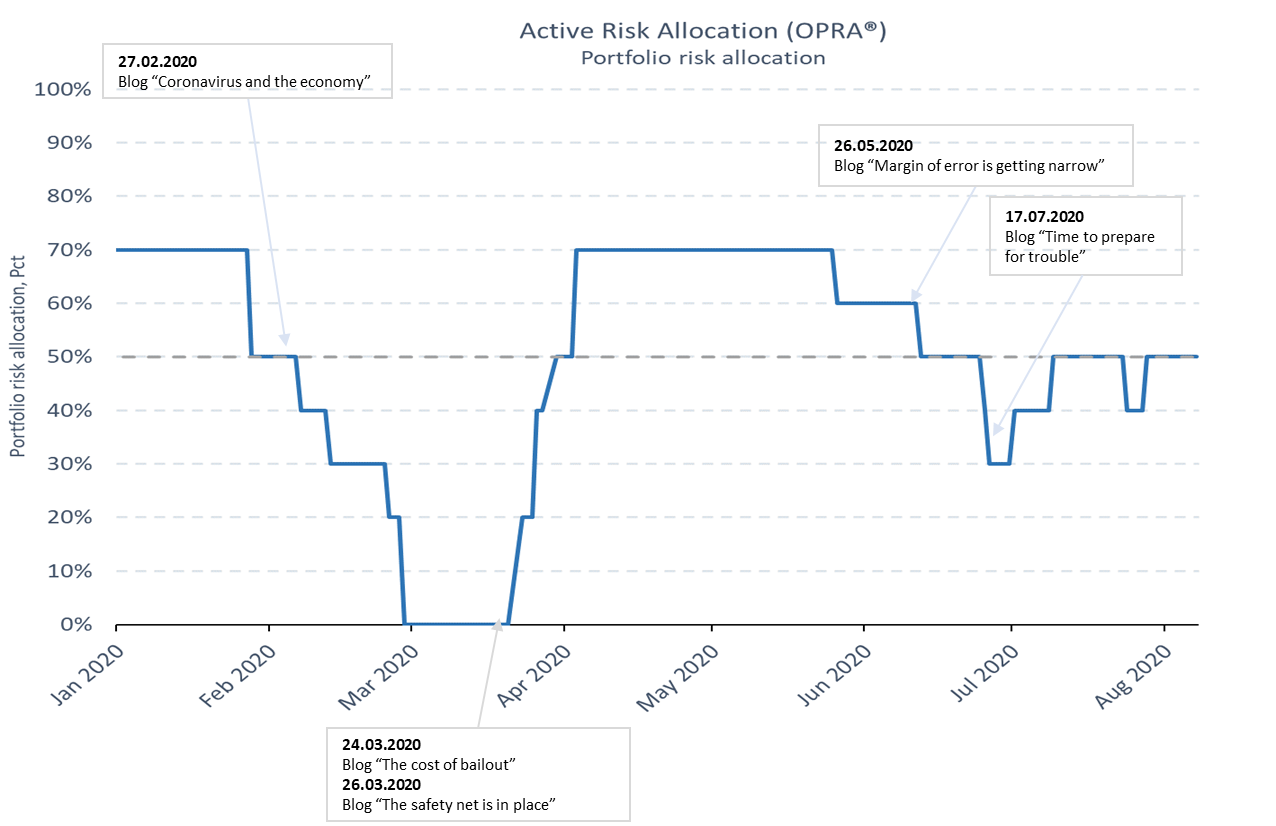

The recommended risk allocation has stabilised around neutral after a short period of advising slightly below average risk exposure. Seen from a top-down view allocation is merely simmering around neutral towards benchmark following the March-June rally.

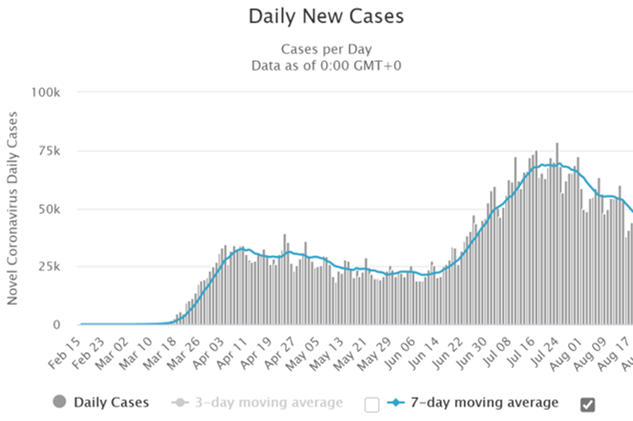

Our ARA Technicals risk component is the main driver, with the input coming mainly from the stock market. It happens to coincide with the US CoVid-19 spread having passed its next apex around the 3rd week of July.

| Factor group | Tendency |

| Fundamentals | Weakening, with an important US CoVID-19 twist |

|

The development of the real economy has followed our prediction from May and the initial post-covid-19 stimulus recovery continues to fade. As a consequence, the US budget deficit has exploded, Fed will be keeping rates lower for longer and the USD weakened, while stock markets have continued to “look through” any risk thrown at it. Stock market expectations are still that a strong economic V-recovery will happen in Q3. USA’s CoVid19 spread has passed its next apex. The trend in new infections currently correlates positively to bond prices. Negotiations over the new US stimulus packages expected by 1 August broke down and Congress remain in summer recess. |

|

| Risk & Volatility | Stabilised |

|

Coordinated monetary and fiscal expansion have lifted all asset prices. It means that correlation between asset classes have increased and diversification gains have diminished. The improvement in US CoVid-19 statistics however is presently overriding other input and is normalising the correlation for that positive CoVid19 development supporting risk assets while weighing on US long bonds. |

|

| Market Intelligence | Factors supporting the neutral risk taking have stabilized |

|

Signals from the fixed income market continue to follow the real development of the extended CoVid-19 shutdown, slower economic recovery and no stimulus extension. Stock market participants continue to ignore fundamentals and appear to react only to positive news. |

|

| Technicals | Stock momentum improves, bonds pause |

| After pausing a few months stock market momentum has picked up slightly again. |

Proprietary indicators

Our Portfolio Risk Allocation indicator remains around 50% indicating a risk exposure of neutral to benchmark.

The number of large re-allocation events so far remain around historic average of 1-2 per year. Still it has had a dramatic run this year, from a 70% count overweight in January and in April-June. In February as well as in June, the fall in the indicator was mainly a reflection of the increased correlation in the main asset classes and the corresponding lack of diversification possibilities in a balanced portfolio (except for cash and short exposure).

Since late March the subcomponents for aggregate monetary and fiscal liquidity have been the main fundamental drivers.

The probability of a risk-off scenario was increasing over the summer. The Fundamentals component weakened as hopes for a V-shaped recovery did not find support in real economic data. The fixed income markets adapted to the weaker growth prospects, and long duration government bonds performed while negative fundamentals were mostly ignored by risk assets.

The latest development has been improvement in the Technicals component which so has balanced the drag from weak Fundamentals – for now.

A primer on our approach (nerdy)

Origo’s Asset Allocation advice is built on a simple observation: Much of the portfolio theory taught in (Business) school is useless. Not because it is wrong, but because it does not deal with real life situations.

We believe it is necessary to be systematic and pragmatic at the same time. In practical terms this means that follow the same indicators day out and day in, but we do not expect them to play the same roles all the time. In particular, we look for changes – short term and long term – in the correlations between the main asset classes.

We have classified all the 150 or so variables we monitor daily in four broad groups:

Macro- and microeconomic factors (the Fundamentals)

These always win in the long run. But while waiting for this to happen, important possibilities may have been lost. So while this group of factors are very important, mostly they give the background.

Risk and volatility factors

This group of variables are based on actual day-to-day observations. We consider cross-asset correlations, volatilities and diversification risks. Certain correlation patterns are important indicators of trouble to come

Market Intelligence

This is a headline for all data indicating the ephemeral “market sentiment”. A large number of survey data exist giving indications of the markets’ perception of risk. Some markets, in particular swap markets, as well as short term money markets and forex markets give important real-time indications of the shifting market sentiments

Technicals

No introduction necessary. Technical factors are valuable but cannot stand alone. They need to be seen in conjunction with other variables. When used carefully, they can be used to identify major turning points in both directions.

Our proprietary indicators

Our understanding of the market dynamics needs to be made actionable in order to be useful.

Hence, we have taken the most important of the factors mentioned above and aggregated them into two main indicators, a market risk indicator and a portfolio risk allocation indicator.

Our market risk indicator combines some fundamental factors, some volatility and correlation element as some sentiment data to give an indication of the current risk situation. We call this the Origo Market Risk Indicator, OMRI.

A strong asset allocation is the basis for any satisfactory long-term return. Asset allocation is always built on a diversified portfolio where the correlations between assets change over time. We have found it very useful to group asset classes in “risk assets” and “non-risk assets” instead of “stocks and bonds”.

Our portfolio risk allocator (OPRA) summarises the max recommended holding of risk assets in a diversified portfolio – based on any “strategic” limitations a given investor has to consider. An institutional investor may e.g. hold between 25 and 75% in risk assets. So when our OPRA says 30%, this investor should hold 25% in risk assets plus 30% of the difference between min and max allocation. This client should hold 25% + 15% equals 40% in risk assets – in the lower end of the permitted range.

Portfolio composition

We construct a portfolio by optimising (i.e. minimising) the risk dispersion, subject to the constraints set by OMRI and OPRA and any constraints set by a higher authority, such as the law or the board of directors.

Reading Time: 4 minutes