Regardless how sticky inflation eventually turn out to be, our point remains, the risk premium of inflation to stick around is priced too low.

Broader adoption of this view will meaningfully affect all financial cash-flows. For investor such scenario will require strong risk management or high tolerance for big swings in the capital.

Setting the scene

Rising prices on essential goods and services are felt in some way by most people across the planet. Investors are rightfully evaluating if they have really done enough to inflation proof their portfolios.

After all, how many are around who has investment models and experience for a scenario of rising inflation, or to the point, in a relentlessly rising interest rates? Falling interest rates has been a main factors of asset performance, shielding investors for the consequence of poor investments for well, the past 40 years.

Throughout 2021, inflation expectations were verbally managed by Central banks (CB) repeatedly describing the inflation development as “just a transitory phenomenon”. By 4Q 2021 that rhetoric changed. Core inflation proved stubborn and even started to broaden.

Just a reminder that CBs have been a dominant force to financial markets increasingly over the past 15 years. CBs have embarked on reversing course on monetary policy. Adjustments in capital markets are difficult to argue against.

Covid19, the “joker” to accelerate monetary tightening?

While we’re all complaining about restrictions our behaviour has largely found a new normal as daily covid19 updates come with the same regularity as the weather forecast.

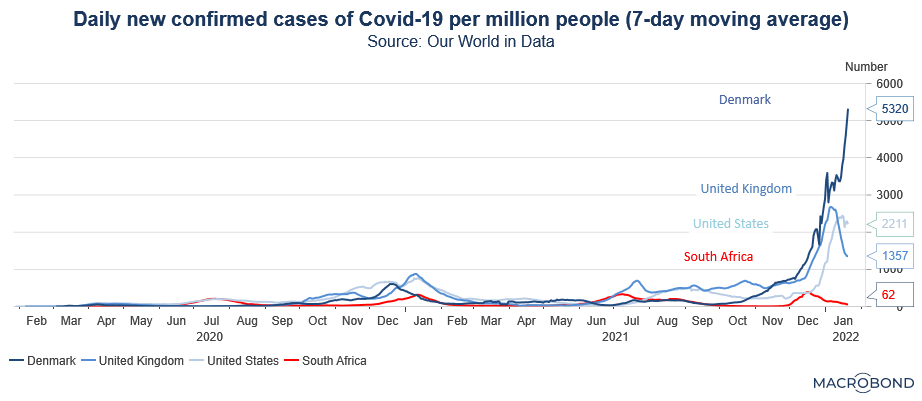

However, rapidly increasing new covid1-9 infection cases so far place manageable stress on the hospital sector. This is a scenario that could potentially look like sweeping global immunisation by combined vaccination and natural infection.

So, what if what we are witnessing is indeed the Covid-19 end game? How would that affect the pace of Central bank tightening pace? Hint, busier than presently discounted by markets.

We suspect that the financial markets may be in the process of adjusting towards such a risk scenario. That this is the causality for what in financial markets 2022 so far looks like a “mini taper tantrum”.

The taper tantrum term was coined as then incoming US Fed chairman Ben Bernanke in 2013 after the financial crisis briskly announced that the Federal Reserve would slowly put the brake on further QE (bond purchase) programs.

While clear speak may be the lingo used in a university auditorium to keep students awake, it caused collective panic in financial markets and all asset types dropped for about half a year.

The Fed QE balance in 2013 was around USD 3 trillion – today it’s around USD 9 trillion.

That aside, we believe the above is part of a larger process which the covid pandemic has only postponed. Reference Cry Wolf (Feb 2021), Jackson Hole (Aug 2021). A scenario which could potentially reset portfolio returns to say, the before Covid-19? We will follow up on details in separate blogs.

Stay tuned

Reading Time: 3 minutes