A new stimulus round has finally taken form in EU and US. The coronavirus vaccine inoculation has started. The UK Brexit (or)deal is done. The primary financial assets, stocks and bonds are both near all-time-high, pricing in all the above. So just as evidence mount that the US/European economic recovery is stalling and a new coronavirus mutation is surging around the globe, what else can possibly go wrong?

Second round of US and EU economic stimulus

EU and the US have agreed new stimulus packages to keep their economies afloat during the coming months. The total size of those two initiatives is about USD 2800bn corresponding to 3.2% of the global economy. When we reported on similar initiatives in March, there was a broad consensus that CoViD-19 would have a strong, but short-term effect.

Back then all the initiatives taken were built on the expectations that the downturn would last a quarter and then the economies would roar back.

That did not happen. The virus came roaring back as summer ended, more widespread than before. A new strain (aptly named “SARS-CoV-2 VOC 202012/01”) is threatening to help the spread of the virus accelerate even faster. Vaccines are now being distributed but are unlikely to make a dent in the virus’ progress until second half of 2021.

Add that politicians are running scared of public opinion and that the handling of the outbreak in the US has been hopelessly bungled from the start. All of this points to a continued economic effect of the pandemic well into 2021.

The longer-term effects are already visible. China has moved forward with a borderline brutal approach to social distancing, forcibly locking down large population groups. The result has been impressive, and the country is gaining relative strength in the global economy expected to be the world’s largest now already by 2028.

Going into the details of the sectoral changes will be very detailed. Instead, we look at the so-called “scarring” of the economy. By this is meant the difference between the actual economic output and the long-term potential growth rate.

The most optimistic voices expect a return to the long-term growth path already by the end of 2021. Others believe it will take the rest of the decade before the economic losses have been recovered.

We do, however, think there is no way the global economy will have returned to the long-term growth path by the end of 2021. Earlier estimations from the US Fed have pointed to US economic output at the end of 2023 still being 4% below trend. See details in blog “Time to prepare for trouble” from 19 July 2020.

Losing 4% relative to the long-term trends, still compares to a significant recession. The initiatives from the USA and EU are attempts to mitigate the situation.

The known unknowns

The financial markets are already having the jitters. Is the package large enough? No, but it will bring us a bit of the way towards recovery. Will the skyrocketing government debt destabilise the Government finances, forcing up bond yields? That’s a tossup, but as long as inflation remains low, we can live with it. Will inflation pick up? Right now, inflation is pretty stable at extremely low levels. Will we see a meltdown in corporate debt once the central banks withdraw the support to smaller companies? Very likely, at least for the zombie companies who could not even pay their interest on loans.

No action on asset allocation

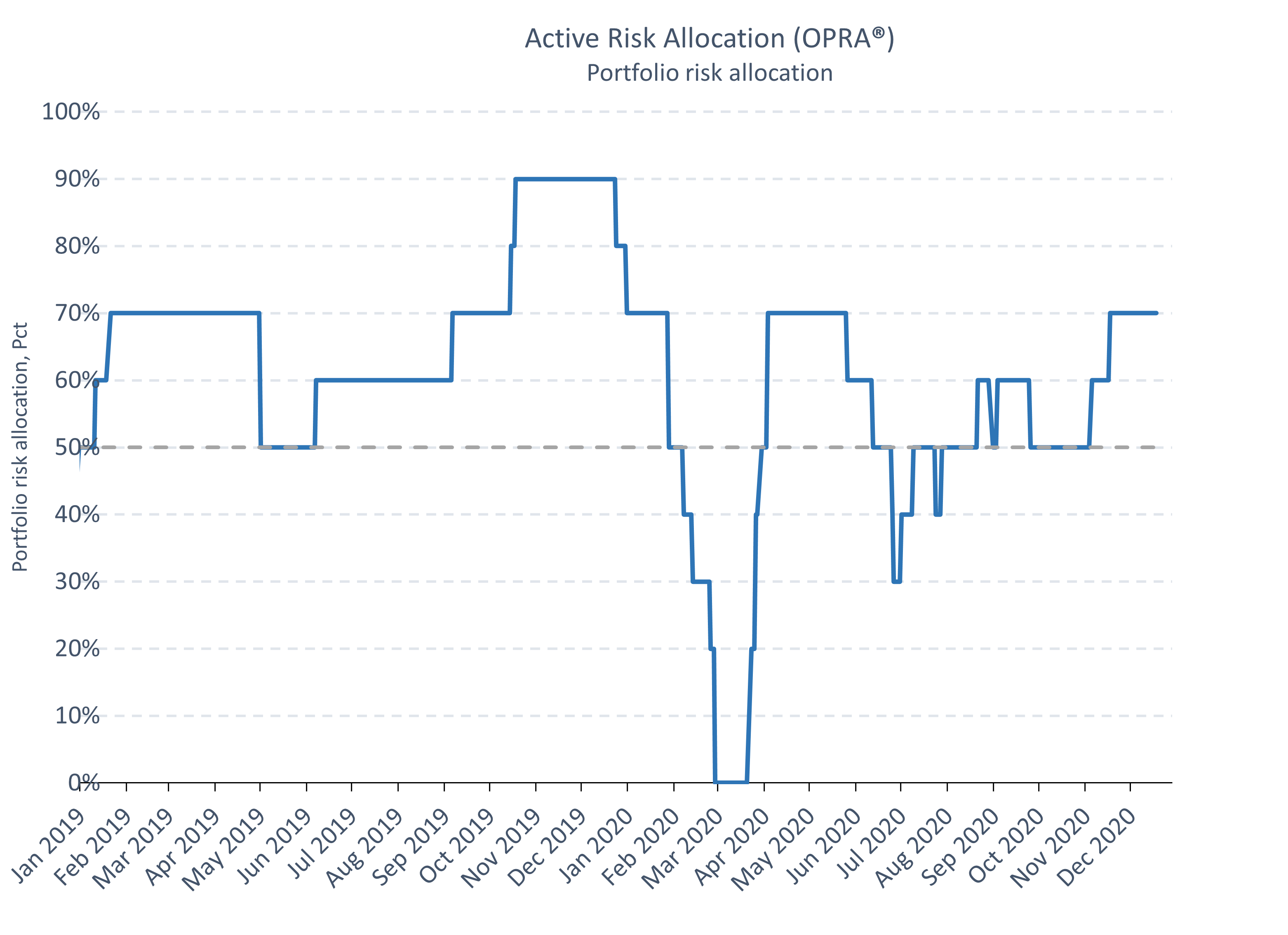

We currently observe no signals to justify change to current asset allocation. Our Portfolio Risk Allocation indicator having stabilised around 70% indicating a risk overweight relative to benchmark.

Our current measure of investor sentiment is propelled by expectations of fresh economic stimulus and not by improving real economic activity. In fact, our indicators for euphoria/panic have again reached fresh historic highs. Based on statistics this is not in itself a signal for investors to panic scale down on exposure to risky assets.

Investor exuberance right now is however a thing to be mindful of. For example, should smart money investors believe they possibly “bought the rumour” – 2. round government stimulus, president-elect Biden, vaccine, and Brexit – they might be on edge for an excuse to “sell the fact”. Stay tuned.

Reading Time: 3 minutes