An invisible portfolio risk

To most market participants, financial risk is like talks about the climate crisis, its only “real” when the sea level reaches your living room.

Macroeconomic risk is now rising as Central Banks are stepping up efforts to dismantle 13 years of continued crisis stimulus programs. It seems likely it will trigger a global asset revaluation. This will impact every financial asset with a cashflow.

While this by now is media headline, another kind of risk is increasing, portfolio risk. The primary assets stocks and bonds are beginning to move in sync.

An emerging portfolio risk

Composing a portfolio of different types of assets is supposed to shield the capital as in general some assets move up while others move down. Diversified portfolios are less volatile. Unfortunately, this is not always the case as sometimes assets begin to move in sync ”Diversification works – most of the times” (Feb 2021). In such cases, diversification does not work. This tends to surprise market participants who usually do not notice that correlations vary significantly in the short run.

This phenomenon was fully visible last time in March 2013 as then US Fed chairman Ben Bernanke was quoted by a journalist supposed to have good relations with Bernanke announced that the Federal Reserve would slowly put the brake on further QE (bond purchase) programs. A scenario not unlike the one today, why this dynamic must be followed closely. The market reaction was strong and immediate. Bonds and stocks fell worldwide, forcing central bankers to come out in force and emphasise that rate hikes would be gradual

The US Fed balance sheet in 2013 was around USD 3 trillion – today it is around USD 9 trillion. We can only hope Fed chief Powell has learned from the past as he speaks this week.

Crypto’s, not useful to diversify risk, either

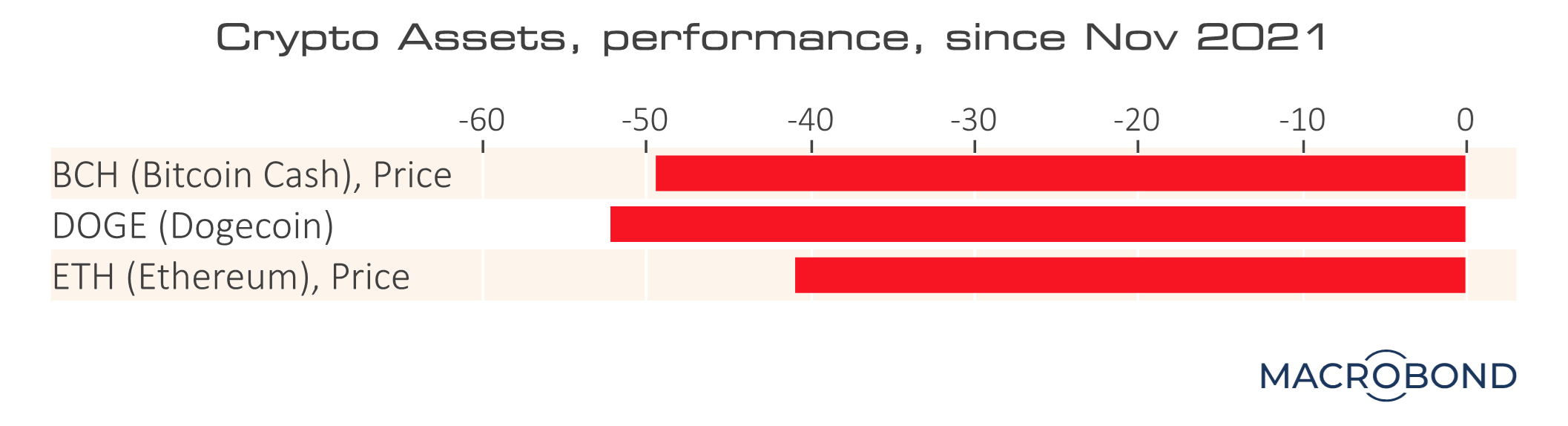

Starry-eyed crypto investors have claimed that this “asset” class should add diversification benefits to a portfolio. This statement is currently somewhat challenged, to put it mildly.

Cryptos correlation to equities is today near 1, meaning they follow each other in lockstep. No diversification effect is available.

Equally challenged are theories of cryptos as a protection against inflation. While inflation expectations have soared, crypto prices have dropped some 50%, in less than 2 months. “Freedom fighters vs Central bankers” (Mar 2021). Go figure.

Our crypto verdict remains – a combination of a bad idea and a brilliant technology.

Reading Time: 2 minutes