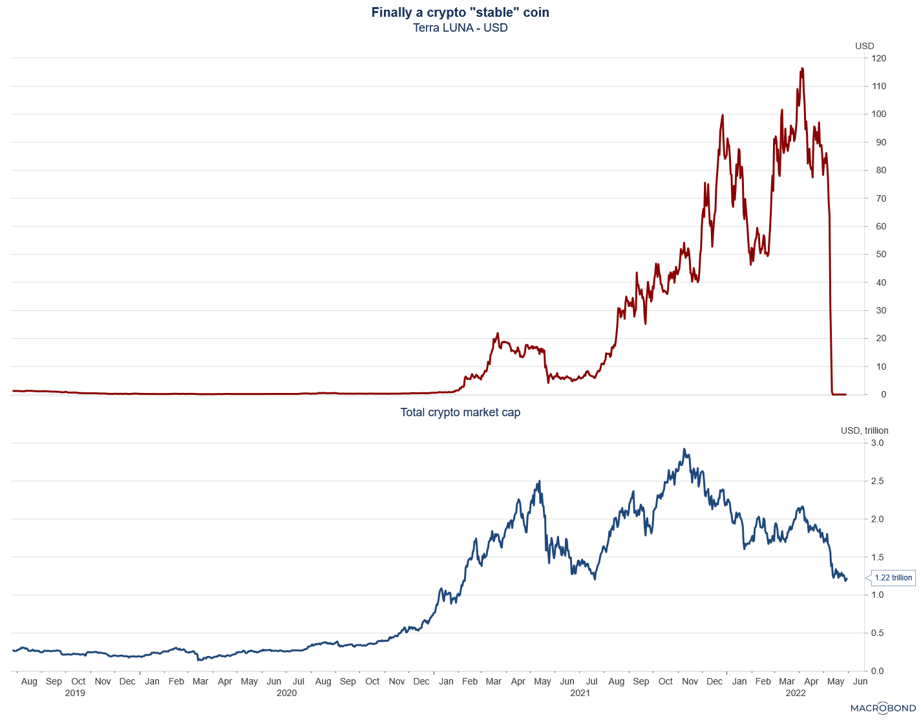

Cryptos have seen significant losses. Readers of this column (blog Mar 2021. Jan 2022) will know that we are not the slightest surprised. We do, however, believe it is necessary to outline how the movements in cryptos are simply part of something much larger. Pricing of asset classes are all being re-evaluated in a sequence that is still unfolding. There are no tangible signs that the movement is over.

Too low for too long

Central banks are likely to have kept real interest rates too low and money market liquidity too high for too long. The CoVID 19 pandemic led to further errors. When interest rates are too low, the risk is high that large amount of capital are misallocated into investments with little or no economic sense when seen in a macroeconomic perspective.

The ongoing asset re-evaluation cycle should probably have started in the autumn of 2020 as Pfizer and others indicated that a vaccine would be available shortly. At the same time, signs were clear that the massive assistance offered by governments and central banks to mitigate the potential economic chaos had been very effective. Political expediency led to the policies not being reversed early enough. The emerging chaos in the global supply lines had not yet emerged as a clear inflationary threat, but signs were visible.

Over the summer of 2021, price adjustment process gained traction. Bond markets did not buy into the expectations that inflation would be transitory as mainly the US Federal Reserve had repeatedly claimed, and government bonds tanked. Higher yields then hit credit spreads in the corporate bond market and then by Jan 2022 the stock markets discovered what was going on.

At this point of time, it would be normal to see falling prices in commodities. The Ukraine war and still-wobbly supply lines have led to price increases instead.

Next in line

Private equity (PE) and the real estate (RE) are likely to be next in line. These asset classes have more than a few features in common. They are essentially long cash flows whose present value is calculated using a too low discount factor. They are highly illiquid and highly leveraged. Their valuation is far away from being mark-to-market.

The PE and RE asset classes have seen the bulk of capital inflow over the last 5-10 years for most private investors and many pension funds. Any sign of weakness will have profound consequences. It appears safe to say that current portfolio valuation is these segments is highly likely not to reflect a realistic market value.

Markets will go through the necessary price adjustments, however painful, and will then recover to a degree that reflects their inherent economic value.

We will continue to follow up on this story.

Crypto winter is coming

Against the above backdrop, the crypto meltdown is an entertaining sideshow.

We have already made our views clear: They are “assets” without intrinsic value, they have attracted libertarians, money launderers and starry-eyed millennials. They should not be condoned as “currencies” until central banks have taken control. But they are built on a very clever technology. Cryptos should be consigned to the scrapheap of history, but blockchain technology will go from strength to strength.

While this view may have been heretic in March 2021, we are heartened to have support from the venerable institution Morningstar.

In a recent interview with a Morningstar crypto expert, we found the following quote:

“cryptocurrencies at this point just don’t have a ton of use cases outside of the four corners of our brokerage windows (…) as things continue to develop within cryptocurrencies, it’s really important to treat them as investments that are really kind of like an entrance fee to experiment with the technology, and not so much like a stock or a bond with fundamental values that we can measure (…) There is no floor for where the price can go. A lot of these assets could plummet to zero tomorrow”.

We recommend crypto investors begin looking for a day job.

Reading Time: 3 minutes