Lately, the US Federal Reserve has acknowledged having misjudged the timing, size and staying power of inflation and consequently accelerated monetary tightening.

Should the broader finance market have a similar moment of introspection, the ongoing asset re-pricing reflecting a lower fair value of most assets could equally accelerate meaningfully.

Recapitulation

The background: 10-15 years of extreme monetary policy, an economic snap-back faster than most feared after the initial CoVid chock, another US fiscal giga-stimulus package to an economy already running hot on full employment capacity and central banks dithered to start unwinding of emergency stimulus the minute a vaccine was in the mail and inflation gaining momentum.

And here we are, with inflation at levels unseen since the late ’70s and interest rates are soaring.

Readers of the blog series ”Cry wolf” (26 Feb 2021) and “Crypto winter is coming” (May 2022) will recall that in our opinion the current scenario is not just-another-correction, but a potentially large re-pricing of all financial asset prices. We also laid out a likely sequence – first government bonds, then equities and high-yield bonds to be followed by private equity and the real estate market.

Hence, a couple of points we still do not see are priced into financial markets, yet;

- As long as interest rates have not peaked, NO asset prices will find a bottom.

- Negative real rates are not sustainable for a long time as they lead to the wrong allocation of capital

- When the market believes that real interest rates are peaking, they are in fact just normalising and will stay high and NOT fall back into negative territory.

Entering the illiquidity trap

Our observation of a broadbased re-pricing of financial assets has been ongoing since early 2021, led by the US bond market. Then followed by the stock market – with some 12 months delay – at least for a first leg down.

Today, even when talking about estate assets it is now no longer bad style to say out loud that prices may drop. The development follows our chronological roadmap, why we begin to zoom in on the next phase.

Illiquid assets tend to have some common characteristics:

- being illiquid (!), meaning difficult to sell when you want, as the impetus to sell tends to coincide with everyone else

- have a high degree of leverage

- as a consequence, a very high degree of interest sensitivity.

These asset classes are where the bulk of capital has been invested in the past 10 years.

Policymakers are scrambling to push market participators and particularly the Life & Pension(L&P) segment loaded with these assets to step up the process of re-evaluating these assets towards market prices.

Depending on the speed towards such revaluation, this somewhat counter-intuitively may have a dramatic side effect on the liquid assets. Essentially, on top of the ongoing re-pricing, a liquidity wave may emerge as investors are forced to sell not what they should, but what is possible.

In the event of such capitulation development, we would see this as the first sign of a bottoming process in asset prices which could otherwise take years.

When markets wobble…

You may have heard the argument that the future is unknown, everything can happen, and therefore staying passive is the best investment strategy. While the first is obviously true, some developments are more likely than others.

When markets fall, the diversification across asset classes fall and the portfolio suffers heavy losses. That is the thinking we have built into the systematic approach we named Active Risk Allocation.

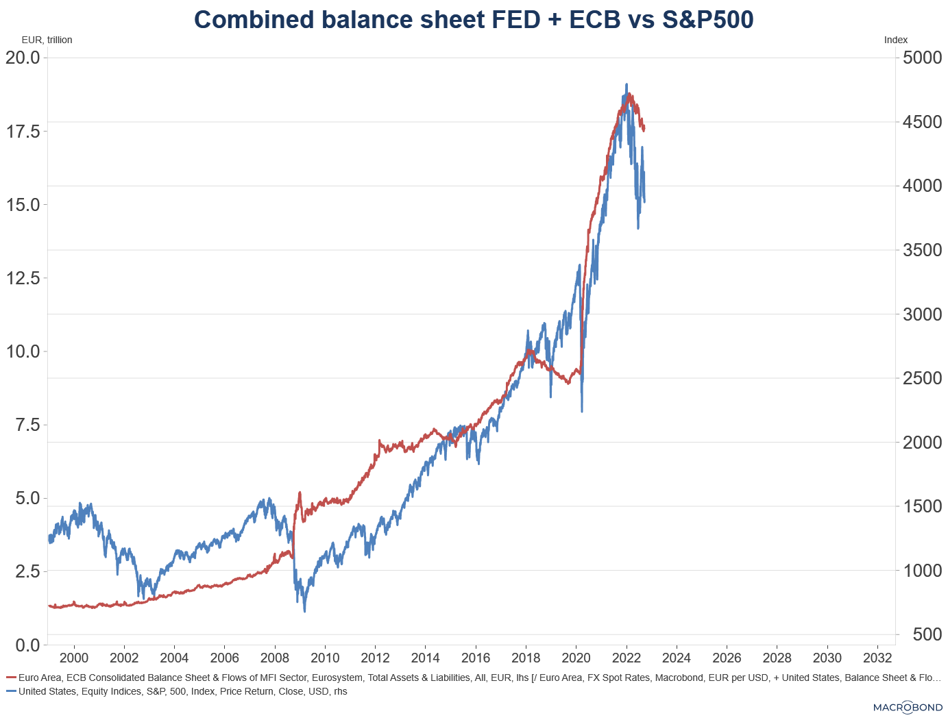

The difference in approach is particularly clear in periods when passive management does not work – as throughout 2022. Passive management builds on the existence of diversification across asset classes, except that in major market movements this diversification evaporates and many types of assets see strong positive correlation. It is also broadly assumed that bonds or stocks may experience temporary setbacks for a year or two, but will then quickly bounce back to new highs. This belief is understandable given 3 decades of persistent drop in interest rates, and more than 1 decade of extreme central bank stimulus. [See chart below].

We believe that a reversal in any of these two drivers, or as in the current case both simultaneously, is likely to reveal historic misallocation of capital and structural complacency among many asset managers. In our Active Risk Allocation we measure the correlations which are by no means stable. We also believe that asset allocation cannot be built on long trends alone. Any long trend will see periods of reversals, long enough to warrant portfolio adjustments.

Reading Time: 3 minutes