Active Risk Allocation (ARA) update:

Asset allocation has for decades been known to be the most important single factor for investment return. Our Active Risk Allocation aims to get the balance between asset classes right. Sometimes we can also derive useful information about a single asset class from the indicators underlying our approach. We are currently observing signs that a major allocation change is under way.

Sector rotation

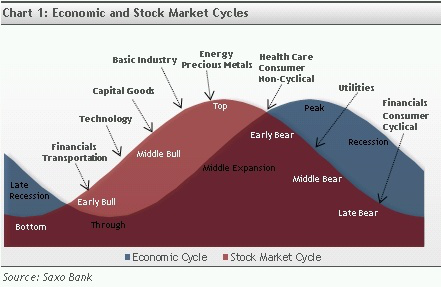

We are almost sure that a sector rotation is building in the stock markets. Such a scenario has for a while been seen as the “CoViD-19 vaccine” trade – sell what has profited from the downturn and buy stock that will profit from a recovery. Our data suggest that this move is starting now.

The correlation matrix between equity market sectors indicates a move away from defensive sectors (utilities, telecom, healthcare) towards today’s unpopular sectors, the pro-cyclical sectors (finance, energy, transport, hospitality).

The IT sector is heavily crowded, which could point to a sharp fall. We would not dare to predict a crash, but we are rather certain that the dominant FAANG (Facebook, Apple, Amazon, Netflix, Google) will lose their leading roles in moving the markets.

If these trends prevail, the sector rotation will be the key to excess performance for the remainder of 2020.

The economics do not always dominate stock markets in such a direct way, but as stated by the famous stock market analyst Mark Twain: “History doesn’t repeat itself but it rhymes”.

Asset allocation

The pro-cyclical dynamics are currently much clearer between equity sectors than between the broader asset classes.

It is, however, significant that US treasury long bonds and gold seem to be forming a top.

Long bonds and gold have been the best performing assets in 2020, indicating how deep a downturn the markets have expected. The beginning equity sector rotation could prove to be a first signal that in recession/risk-off assets as long-bonds and/or gold and/or are near the end of their strong run and will also likely put renewed pressure on the USD.

____________________________________________________________________________________________________________________

The Origo approach

Read more on our models and how we use them here

Reading Time: 2 minutes