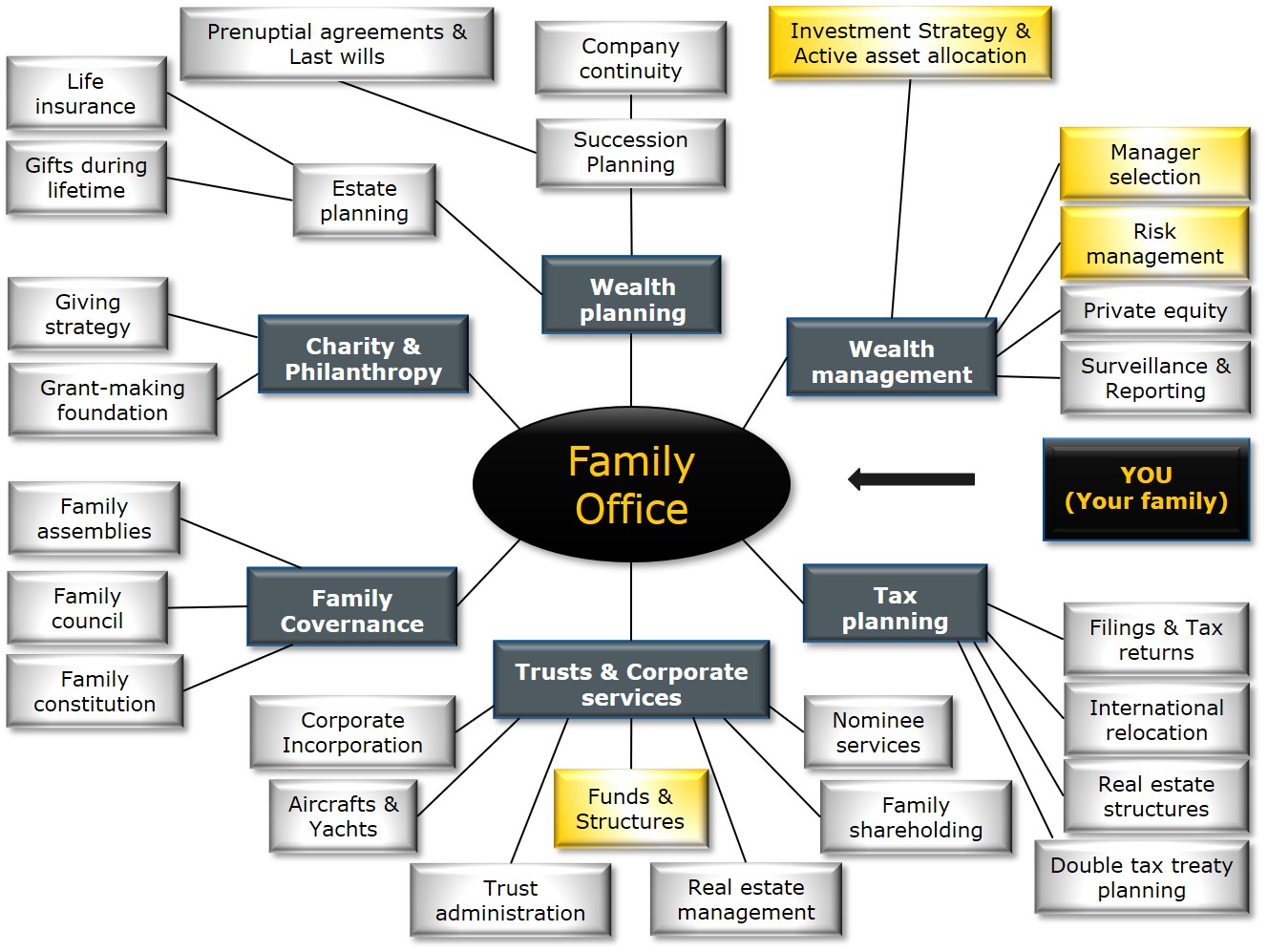

Family office services

Planning for generations

It is customary for a wealthy family to wish to grow and transfer wealth across generations.

One possibility is to make the handling of the wealth more professional by employing staff with a simple brief: to make sure that the wealth is handled as wanted by the person(s) who created the wealth.

(Touch chart to enlarge)

There are no real limits to how a family office can be organised. It may simply be a personal assistant. A large family with significant wealth may have a family office with staff ranging from investment advisers, lawyers, property managers and philanthropy directors.

Clients with Origo can expect:

- Financial Portfolio Optimisation – A focused analysis and strategic recommendations tailored to balance financial assets and liabilities.

- Investment Strategy Advisory – Personalized guidance on financial asset composition, informed by our proprietary risk assessment models and market insights.

- Transparent Reporting – Direct access to your investment recommendations and performance data, with an ethos of transparency and accountability.

- Banking and Financial Relationship Management – Expertise in managing and negotiating with financial institutions to uphold your best interests.

- Succession and Inheritance Planning – Strategic assistance in planning for generational transitions, ensuring your legacy is preserved according to your vision.

We engage with clients on the principles of integrity and value. Our compensation is straightforward – based on service complexity, ensuring our interests are aligned with delivering results, not on asset size or transaction volume.

A matter of trust and competence

No matter how a family office is organised, a number of conditions must be met in order for the wealth owner to have the best services at hand. A few principles apply:

- Conflicts of interest must be absent

- Long-term investment strategy should meet the financial life goals, time horizons and risk appetite of the wealth owner(s)

- The right competencies should be at hand for the job. Most family offices bring in external experts when needed

- A family office should represent the best in terms of transparency regarding costs and have the right incentives for the staff

Origo Consulting can help with the following related to the investment portfolio of a family office:

Establishing long-term financial goals

Many true long-term investors – such as university foundations – have developed methods and procedures to balance long term needs for investment with short term needs for liquidity to cover the operations. Add the acceptable level of risk. These methods have yielded solid results over decades and are well-documented.

Yet such methods are oddly absent in discussions about the needs of family offices.

Contact us to hear more

Selection of investment managers

Using outsourced managers is a question of trust. It does not matter if the manager handles your assets on a single-line basis or you have bought into an actively managed investment fund.

In both cases, Origo Consulting is a source of knowledge on how to select such external managers.

Check out how we can assist you with manager selection

Evaluation of outsourced managers

Family offices frequently outsource the investment management of a portion of the family wealth to external managers.

It is simply good practice to regularly evaluate the managers to see that the expectations and reality match.

We can perform such analysis of the activities of the managers and provide you with an independent and comprehensive report.

See how we can assist you with your evaluation of external managers.

Asset Allocation

This is arguably the centrepiece of the investment activities of a family office.

Origo Consulting offers detailed advice on how to allocate the part of the assets that are invested in tradeable securities. We use our own well-tested method, modified to suit the needs of your family office.

When it comes to investments that are not immediately tradeable, they should be covered by your long term strategy (see above).

Find out how we work with asset allocation

Creating fund or company structures for the financial assets

Sometimes it is practical to wrap financial assets into a legal structure. Luxembourg offers a wealth of different structures and company forms. These are matched to meet the needs of investors across Europe – and in several other jurisdictions.

Learn more about investment funds